Tauchen discretization

I was looking at the Fortran codes and here’s what I understood (admittedly not very well explained in the paper):

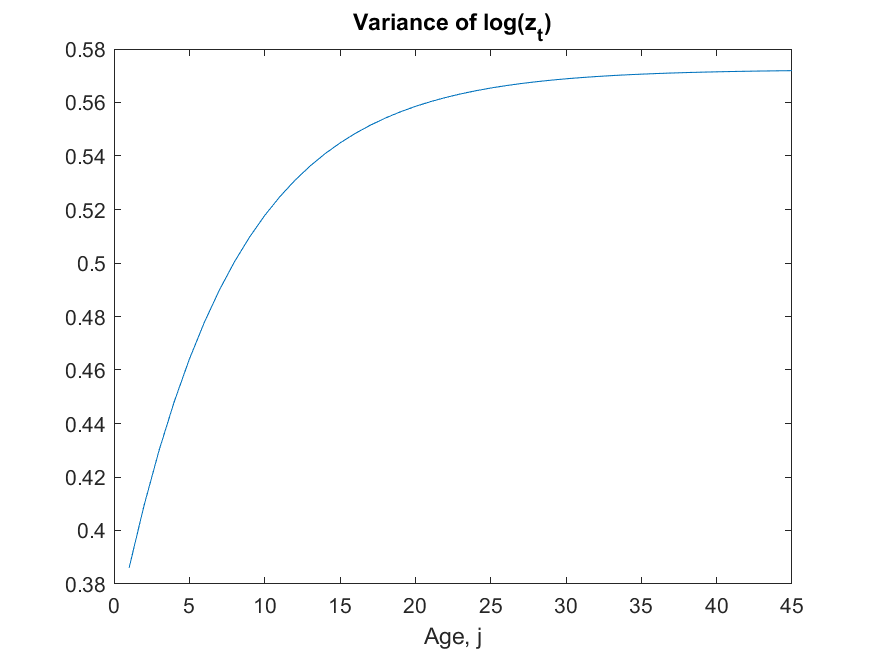

sigma_z_epsilon=0.045 is the variance, not the standard deviation, of the innovation to the productivity shock z.- The Tauchen parameter for the spacing of the grid is set equal to sqrt(n/2) where n=num of states. Since n=7, we should set

Tauchen_q=sqrt(7/2);

- After computing the grid for

log(z), Chen normalizes so that z has mean one.

Here is his Fortran code, see subroutine mchain2.f90. Note that in the subroutine he has several ways of discretizing the shocks. He chooses case 6 which is “Huggett 1996”

case(6) ! Hugget (1996)

rho = 0.96

sigma2eps = 0.045 ! Variance of the innovation

sigma2y1 = 0.38 ! Variance of the initial condition eta(1) at age 1

sigmaeps= sqrt(sigma2eps)

! Inputs: rho, sigmaeps, ns

! Outputs: states (grid). stae (invariant distrib), probs (transition matrix)

! Width of Tauchen??

call Tauchen (states, stae, probs, rho, sigmaeps, ns)

Note that the width of Tauchen is defined inside the Tauchen subroutine. I looked in Tauchen.f90 and here is the relevant part:

! define the discrete states of the markiv chain

sigy = sig/sqrt(1.0-rhot**2)

y(n) =sqrt(n+0.0)/sqrt(2.0)*sigy

y(1) = -y(n)

do yc =2, n-1

y(yc)=y(1)+(y(n)-y(1))*(yc-1.0)/(n-1.0)

end do

It is not very explicit, but it seems that tauchen_q = sqrt(n+0.0)/sqrt(2.0) hence sqrt(7/2). Please let me know if I missed something or if you have a different interpretation

Based on this understanding, I would replace a few lines of Robert’s code with the following:

tauchenoptions=struct();

Tauchen_q=sqrt(7/2); % plus/minus two std deviations as the max/min grid points

[z_grid,pi_z]=discretizeAR1_Tauchen(0,Params.rho_z,sqrt(Params.sigma_z_epsilon),n_z,Tauchen_q,tauchenoptions);

z_grid=exp(z_grid); % Ranges from 0.7 to 1.4

% Stationary distribution of pi_z

aux = pi_z^1000;

prob_stat = aux(1,:)';

z_mean = dot(z_grid,prob_stat);

z_grid = z_grid/z_mean;

Note that I take the sqrt of the variance and that I do the normalization

EDIT

I managed to compile and run the Fortran code and I have verified that the z_grid is correct (here “correct” means that it matches what Chen does).