Kia ora koutou katoa!

I am happy to report my first real success extending OLGModel14 to model some policy questions I’ve been thinking about. The success I’m reporting is much more about the code I’ve got working than actual data that would make it research-worthy.

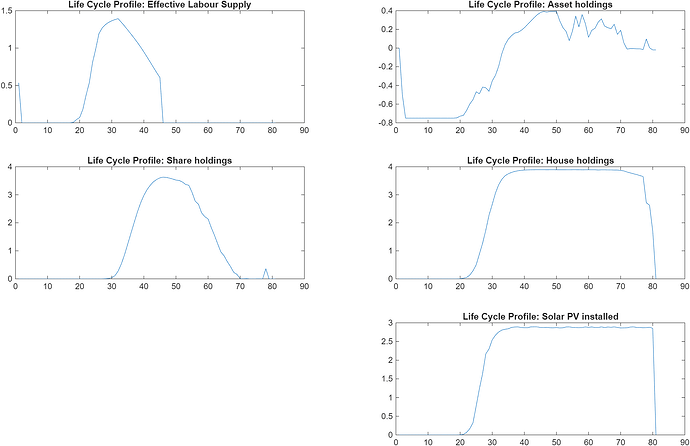

The extension to the model adds housing and solar pv panels to the household decisions about labor, leisure, and share-buying. Specifically, we add assets which allow an agent to take on a certain amount of cash debt (with a suitable credit wedge for loans vs deposits), choosing one of 5 types of houses (rental, and sizes 1, 2, 3, and 4), and solarpv capacity (0, 15kW, 30kW, and 45kW). solarpv is an experience asset that can be installed at house purchase time, or can be upgraded (with extra costs) at a later time. Once installed, it also degrades very slowly over time (creating later opportunities to upgrade).

n_d.household=[15,5]; % Decisions: labor, buyhouse

n_a.household=[11,11,5,4]; % Endogenous shares, assets, housing, and solarpv assets (0-45 kW generation)

%% To speed up the use of experienceasset we use 'refine_d', which requires us to set the decision variables in a specific order

vfoptions.refine_d.household=[1,0,1]; % tell the code how many d1, d2, and d3 there are

I wanted to model the fact that climate change will be irreversibly changing exogenous costs, such as energy costs and housing stock. And with the introduction of debt, I also needed to write rules so that agents could not take out loans to buy shares, only houses (and only to a certain amount).

On my system (with a 32GB GPU), the GE is solved (with loose tolerances) in 5347 seconds, or about 90 minutes. You can see that this model retains the various shocks (exogenous z and iid e) of OLGModel14.

The reported GE is:

Following are some aggregates of the model economy:

Output: Y= 0.27

Aggregate TFP: Y= 1.17

Capital-Output ratio (firm side): K/Y= 1.28

Total share+asset value (HH side): P*S (0.88) + A (-0.36) = 0.52

Total house value (HH side): H= 1.47

Total bad debt (HH side): P*S= -0.00

Total firm value (firm side): Value of firm= 0.57

Consumption-Output ratio: C/Y= 1.08

Government-to-Output ratio: G/Y= 0.36

Wage: w= 1.01

The VFIToolkit is amazing, and I’m looking forward to refining this model further as I learn more and talk with others who are interested in modeling energy transition economics within an OLG framework.

You can look at my repo here: GitHub - MichaelTiemann/OLG-Electrify: OLG model for electrification (Rewiring Aotearoa)